The Philippine Estate Tax: Why Your Family’s Grief Comes With a Government Bill

By: Timons Cabansi | TimonsCabansi.com

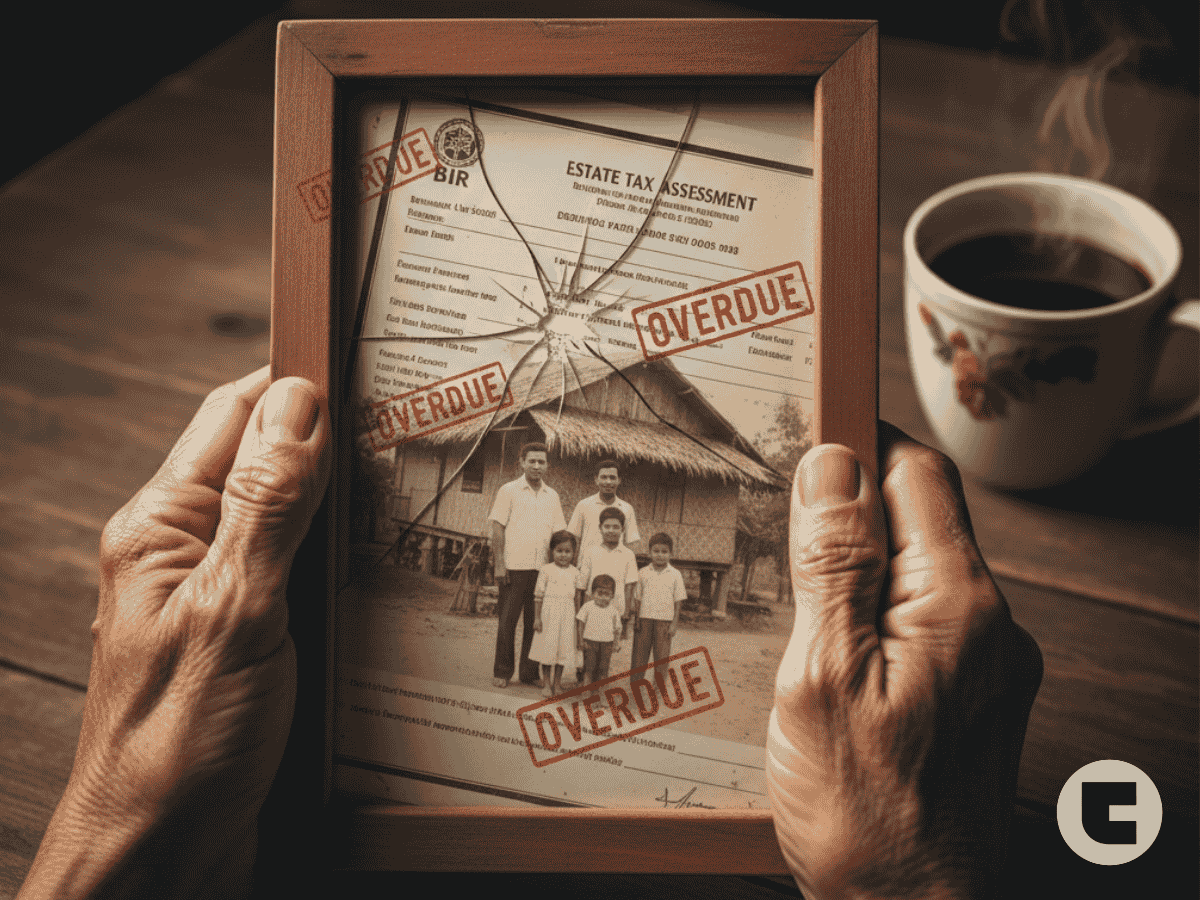

Picture this: Your Lola’s house. The one with the squeaky screen door, the smell of sinigang permanently in the walls, and the garden where you learned to ride a bike. She’s gone now. The grief is a heavy, quiet thing. Then you are reminded by your lawyers, Lola, to do the estate.

Suddenly, you’re not just mourning. You’re calculating. You’re scrambling for documents you can’t pronounce. You’re staring at a government bill for the right to grieve your own family.

Stop.

Before you sell that same bike to pay for bureaucratic paper, let’s talk about the Philippines’ dirtiest open secret: the Estate Tax. It’s not a tax on the rich. It’s a trap for the grieving. And while politicians cry, “Bayad na… bayad tayo! ”, they’re quietly making you pay for a death in the family.

So grab a Kape. Make it strong. This one’s bitter.

Tactic #1: The “Modest Estate” Illusion

The Lie: “It’s only for the wealthy! Your lupa is too small to worry about.”

The Reality: Bullshit. This tax isn’t about Ayala-Alabang mansions. It’s about the 80 sqm family home in Cavite your parents spent 20 years paying off. It’s the tiny rice field in Tarlac. The sari-sari store shelf. Inheritance here isn’t wealth… it’s memory made of concrete and soil. Yet the BIR treats your Lola’s hardin like a Forbes Park asset.

How to Beat The System (For Now):

-

- Know the “Family Home” Exemption: Yes, there’s one. But it’s a maze with a tiny exit. The value exempted is a joke in today’s market.

-

- Document Everything. Like, Everything. Baptismal certificates, old IDs, barangay permits for the dog. The bureaucracy feeds on missing papers.

-

- Talk to the Barangay Captain First. Often, they know the sikretong proseso or a fixer (we still need it if we are already late in filing or we really don’t know the due process) who won’t rob you blind. (It’s not right, but it’s real.)

Tactic #2: The “Penalty-While-You-Grieve” Clock

The Lie: “You have one year to settle. Plenty of time!”

The Reality: The clock starts ticking from the moment of death. While you’re planning funerals, choosing hymns, and just trying to breathe, the government is accruing penalties and interest on your sadness. Delay because you’re broke? That’s extra. Delay because you’re devastated? That’s extra. It’s a misery surcharge.

How to Beat The Clock:

-

- File the Notification of Death Immediately. Even if you can’t pay a centavo, this formalizes your timeline. Don’t let the fear of the bill make you hide.

-

- Apply for Installment. The BIR can allow it. You have to beg, plead, and fill out 12 forms, but it’s possible. Swallow your pride, bring a box of ensaymada to the office. Sometimes, old-school pakikisama works.

-

- Get a Kupit-Proof Lawyer. Not a flashy one. Find the tired, old lawyer in your town who knows the local BIR examiner by first name. His ka-alaman is worth more than a UP degree here.

Tactic #3: The “Global Standard” Deception

The Lie: “All countries have it! It’s normal!”

The Reality: Check the receipts, folks. Look at our neighbors:

Singapore? Abolished it.

Hong Kong? Abolished it.

Malaysia, Thailand, India? Abolished.

Australia, New Zealand? Gone.

Why? Because it’s a cruel, inefficient tax. It raises peanuts for the government but destroys ordinary families. These countries decided that compassion is better economics.

Meanwhile, who doesn’t pay here? The truly rich. They have trust funds, foundations, and lawyers in shiny buildings who make assets vanish before death. Who pays? You. With your parent’s pension, with your paupahan, with your future.

The Final, Dirty Tactic: Turning Legacy Into “Dead Capital”

That property? It’s frozen. You can’t sell it, improve it, or use it as collateral until you pay the death tax. So it sits. It rots. It becomes a burden, not a blessing. The government’ greed turns your family’s sweat into a worthless ghost of an asset. That’s the real crime.

The Ultimate Kape Test for Estate Tax

Before you accept this as “ganun talaga,” do this:

Drink your Kape. Let the bitterness wake you up.

- Ask: “Did my parents not pay taxes on this land when they bought it? On their income building it? On every nail and tile? Why is death the most taxable event of all? ”

- Sleep on it. And if you wake up angry, you’re right.

Final Takeaway:

This isn’t about tax avoidance. It’s about justice. It’s about not charging a ticket fee for grief. Other nations figured it out: taxing inheritance is bad policy and cruel morality.

We need to ask, loudly: Why must we tax love? Why must we put a price on memory?

Until that changes, your only weapon is knowledge. Share this. Talk about it. Make the scandal known. The first step to beating a dirty game is exposing the rules.

Got an estate tax horror story? Share it below. Let’s turn those whispers into a roar.

Frequently Asked Questions (FAQ’s): The Estafa-Vibes Edition

1. Are you telling me to NOT pay estate tax? Isn’t that illegal?

Hell no. Pay what you legally owe eventually. But know this: the system is designed to make you feel guilty and rushed. Your goal isn’t to evade; it’s to navigate without being eaten alive by penalties while you’re still picking out funeral flowers. Get your documents in order first, then talk payment.

2. My parents’ house is only worth ₱2M. Do we still have to pay?

The value is a trap. The “Fair Market Value” isn’t what your parents paid or what you *think* it’s worth. It’s what the BIR assessor says it is, which is often magically higher. That “modest” house can suddenly have a taxable value that will make you choke on your kape. Always, always get an independent appraisal first.

3. What’s the #1 mistake families make?

Waiting because they’re scared. Time = penalties. The moment you can, file the Notice of Death. Even if you submit it with a letter saying “We’re still gathering docs, pasensya na po,” it shows you’re not hiding. Paralysis is what the system banks on.

4. We can’t afford a lawyer. Are we doomed?

No, but you’re on Mt. Pulag-level difficulty. Your first stops:

Barangay Hall: They often have a paralegal or know a retired clerk who helps for much less.

City Assessor’s Office: Befriend a clerk. A box of polvoron and genuine respect can unlock which forms are talagang kailangan and which are pampadami lang.

Online Communities: Facebook groups like “Philippine Estate Settlement” are goldmines of shared trauma and tips.

5. What’s the real reason rich families don’t pay?

Trusts and foundations. They move assets before death. The wealth is no longer in Lolo’s name; it’s in a corporate entity that doesn’t die. It’s legal. It’s smart. And it’s why this tax is a poor person’s burden.

6. “Family Home” exemption sounds good. What’s the catch?

The catch is it’s shockingly low and only for the one property they officially lived in. What if your OFW parent also bought a small condo? That’s fully taxable. The exemption is a band-aid on a bullet wound.

7. What’s the most important document to secure on Day 1?

The Death Certificate. Get dozens of certified true copies. You’ll need one for every single agency, bank, and office. It will become your most hated and important piece of paper.

8. They’re saying we owe penalties from 5 years ago. What do we do?

Negotiate. The BIR has a Tax Amnesty program for estate taxes. It’s their way of saying, “Okay, we know this is messed up, let’s wipe the slate (partially) clean.” Find a lawyer who specializes in this. It’s your best chance to reduce the bleeding.

9. Is there any hope this tax will be abolished?

Look at our neighbors. They did it because it’s bad economics. It locks up property and stops progress. The hope is in making enough noise—sharing stories, writing to congressmen, and refusing to accept this as “normal.” Change starts when we stop whispering and start shouting.